On the 242nd anniversary of our country’s founding this week, I find myself pondering our future as a democracy, the role the U.S. will play in the world, and how the healthcare system will evolve.

Media speculation about the replacement of Justice Kennedy on the Supreme Court, growing public alarm about gun violence and opioid addiction in our society, and the lack of civility in our political discourse are palpable indications that our Republic is under stress.

Similarly, the healthcare industry is under stress and in the spotlight. Public opinion surveys reflect growing public apprehension about access and affordability. The rules and regulations that serve as guardrails for how we operate are in transition: the current administration supports private sector solutions and less government control. And every week, announcements from Fortune 100 corporate elites suggest healthcare is increasingly attractive to big companies that think it’s ripe for disruption. Just last week, GE announced it’s spinning its healthcare operations into a separate company and Microsoft said it’s expanding its healthcare focus. They join the ranks of Amazon, Microsoft, Apple, Intel, CVS and others who promise to shake things up.

Our modern system has evolved since World War II. On June 25, we celebrated the 80th anniversary of the Food and Drug Administration as drug discovery joined insurers, hospitals and medicine as the industry’s biggest sectors. Along the way, medical device manufacturing and self-insured employers emerged as important sectors joining their ranks. These six sectors are the backbone of the U.S. system.

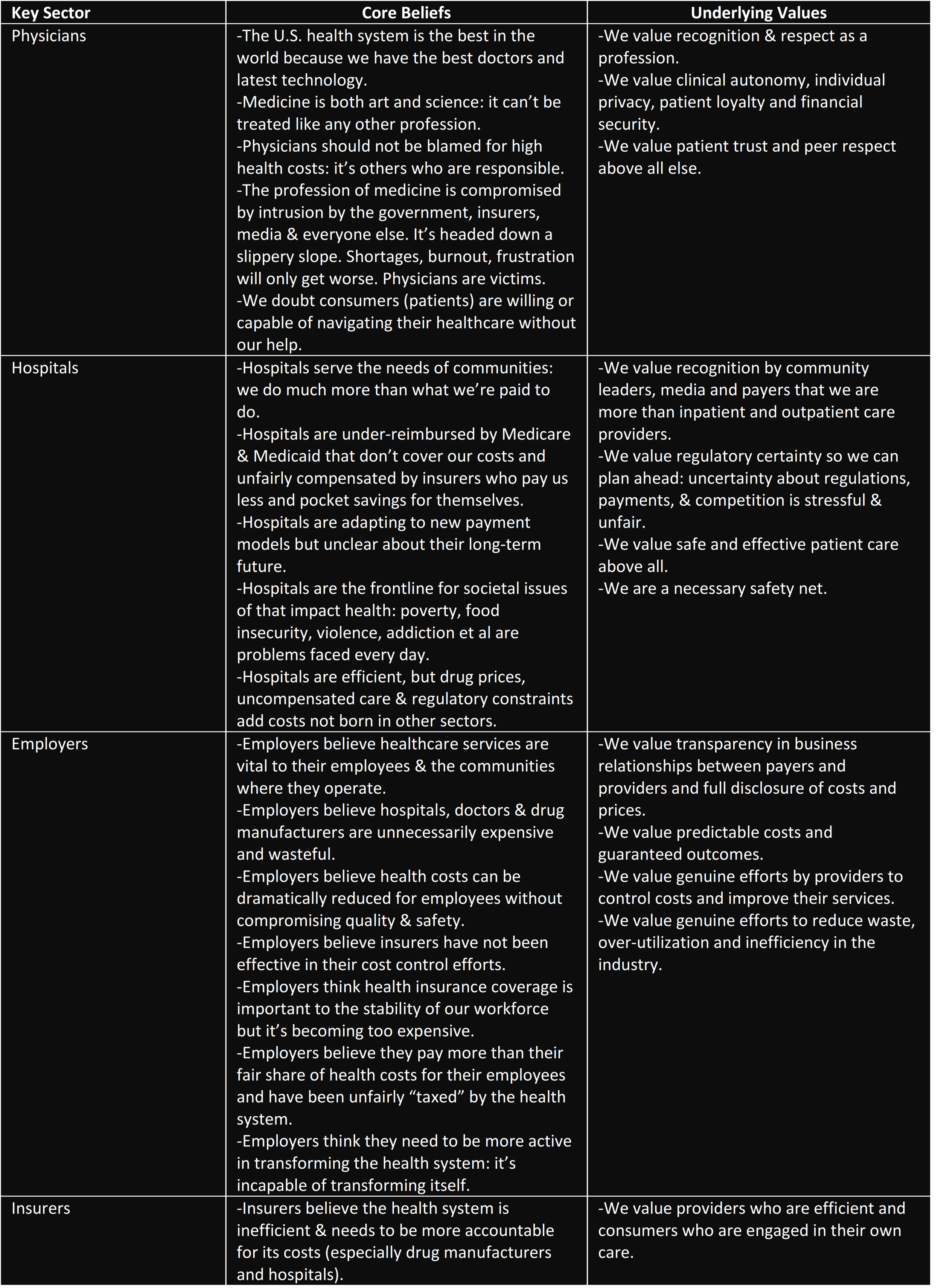

Through these years, they have galvanized their members around core beliefs and values that reflect what they think most important and differentiate themselves from other sectors. As I interact with these organizations and their trade groups in each sector, the differences in each are profound (See Table 1 below).

By design, the U.S. system is built on the principle of private sector competition. So, in each sector, there’s intramural combat among members who pursue growth and market share vis a vis their peers. Consolidation is the current rule of the realm in every sector as margins face pressure and scale is an advantage. What’s unclear is how the disruptors whose operations span multiple sectors will interact with the six legacy sectors and how public policies might change to accommodate their role.

As the debate about Justice Kennedy’s replacement to SCOTUS proceeds and attention is given social issues like drug addiction, gun violence and others, the healthcare industry’s role will be central. And the beliefs and values of each sectors will be on full display as each weighs in on solutions.

Understanding the roles played by each sector and how they might change is important. As new players emerge and as public policy in healthcare changes, it’s likely conflicts between sectors will intensify as their core beliefs are challenged.

What’s the future for our Democracy? Is peaceful co-existence with our adversaries achievable and prosperity for all still our aim? These are the questions we must collectively answer. The same apply to healthcare: what is its future? Is peaceful collaboration among sectors with differing beliefs and values achievable? Is the health and wellbeing of the population still its aim?

The core beliefs held by the policymakers, voters, and the agencies and companies that work in these domains are the basis for the answers.

Paul

P.S. Must read: According to a study by the Healthcare Financial Management Association, Leavitt Partners and McManis Consulting funded by the Commonwealth Fund released last week, researchers found no statistically significant correlation between population-based value-based payment models and total cost of care for Medicare or commercial payers in the more than 900 markets analyzed. They attributed the finding to widely variable levels of participation in value-based programs and lack of adequate financial incentives to encourage provider participation. Provider consolidation and the cost differentials in markets also played roles. “What Is Driving Total Cost of Care? An Analysis of Factors Influencing Total Cost of Care in U.S. Healthcare Markets,” www.hfma.org.

Great weekly reads. The link at the end of this article goes to a different website than hfma’s website.

I appreciate your comments. My one ask is that Table 1 is not pixelated and not readable. Could it be shared in a higher resolution?

roger_call@hermanmiller.com