Despite uncertainty about federal health policies and increased competition from non-conventional players, most healthcare leaders are confident the future of U.S. healthcare is navigable.

That’s the key takeaway from the Modern Healthcare survey of more than 226 healthcare leaders released two weeks ago at the Healthcare Transformation Summit in Austin. They were asked to evaluate the likelihood of 14 future state scenario’s and the level of disruptive impact of each in two- year and five-year timeframes. www.modernhealthcare.com/care-delivery/transformation-summit-stresses-being-smart-about-innovation

SURVEY FINDINGS

Industry leaders believe the federal government will play a bigger role in shaping the future of the health system while sustaining it as a private system. Leaders anticipate the feds will flex their muscles through regulatory policies in the Department of Justice, Food and Drug Administration and the Center for Medicare and Medicaid services and through Executive Orders from the administration.

Most expect the federal government will enact price controls on prescription drugs and accelerate the use of alternative payment models to replace fee-for-service payment incentives. They anticipate federal authorities might tighten rules around hospital consolidation and expand price transparency in every sector. But major changes, like drug importation and Medicare for All, are considered unlikely.

While expecting Medicare and Medicaid to play larger roles, most do not anticipate major changes in the overall structure of the insurance market. Many (44%) think Medicare Advantage will play a bigger role in Medicare coverage and 57% are confident the individual insurance market will remain viable. Otherwise, they foresee no major changes.

By contrast, major changes are expected in the delivery system. Increased emphasis on new models of primary care (68%), the integration of social determinants in care coordination (67%) and expansion of alternative payment models (59%) are considered major shifts. But only 35% feel these changes will slow health spending and only 51% think Medical education will keep up with market changes in preparing clinicians.

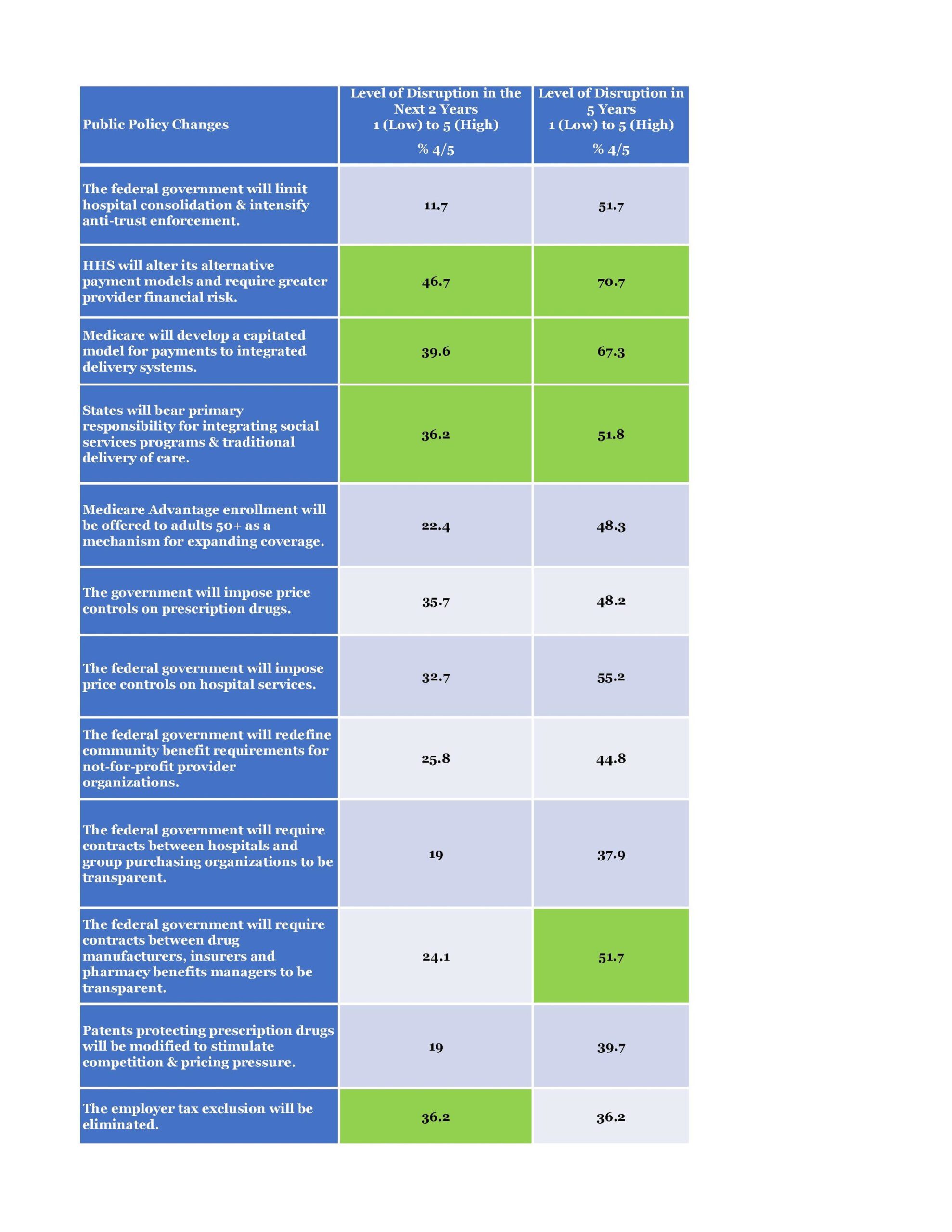

Overall, the disruptive impact of these changes is expected to be high. Industry leaders think disruption will be the result of changes in how providers are paid and increased influence of “external disruptors” in the healthcare ecosystem. Asked to assess the potential disruptive impact of 22 possible changes in the healthcare market in the next 2 years, and within 5 years, three were rated highest:

-

“HHS will alter its alternative payment models and require greater provider financial risk.” (46.7% in next 2 years, 70.7% in the next 5 years)

-

“Medicare will develop a capitated model for payments to integrated delivery systems.” (39.6% in the next 2 years, 67.3% in the next 5 years)

-

“External disruptors will force change in cost, price transparency and consumerism efforts.” (37.3% in the next 2 years, 67.7% in the next 5 years)

MY TAKE

The survey results were somewhat surprising. Industry’s leaders anticipate significant changes in the U.S. healthcare market but reject radical changes like Medicare for All, drug importation and price controls.

They believe the future state will be re-shaped by two major catalysts: federal policies that alter the way the insurance and delivery markets operate and the expanded role of non-traditional competitors in the system. In short, they expect a more difficult environment that’s manageable by leaders who are innovative and not risk-averse.

In most industries, disruptors are successful because they leverage technologies that enable their new business models, they have access to significant capital and consumers are receptive to their alternatives. A regulatory climate that supports private competition and the potential for shareholder return are their starting points. Industry leaders think those conditions are in place today for the development of the future state of healthcare. That’s why private investors put $63 billion into healthcare last year: it’s an industry ripe for disruption.

Industry leaders believe healthcare is going to change dramatically. They think its future is not a repeat of its past. They acknowledge the pressure is on them to lead changes uncomfortable but necessary in their organizations. Some will be successful; others will fail.

Paul

FACT FILE: MODERN HEALTHCARE FUTURE STATE SURVEY 2019

In March, 2019, a national panel of U.S. healthcare leaders was surveyed by Modern Healthcare and The Keckley Group to assess their views about the future of the health system. The results below reflect the views of 226 respondents in the first of the two-phased survey.

In wave one, survey participants were asked to indicate the likelihood of policy changes using a scale of very likely, likely, unlikely, not at all likely or unsure. For purposes of this summary, likelihood is a combination of “very” and “likely” responses.

In wave two, conducted in April, 2019, respondents were asked to assess the level of disruption that might result from proposed changes in public policy and in the private sector in two timeframes—the next 2 years, and 5 years. “How would you rate the level of disruption these policy changes would have on the current U.S. system. On a scale of 1 to 5, with 5 the highest level of potential disruption to the status quo and 1 the lowest.

Wave One: Likelihood

KEY TAKEAWAYS

High likelihood:

•Primary care delivery

•Health + social services

•Drug price controls

Highly unlikely:

•Medicare for All

•Individual market exit

•Spending slowdown

Wave Two: Disruption

KEY TAKEAWAYS

Near Term:

•Alternative payment changes

•Medicare capitation

•Expanded role for states

•Employer tax exclusion elimination

Long Term:

•Alternative payment changes

•Medicare capitation

•Health + social services

•PBM transparency

Wave Two (cont): Disruption

KEY TAKEAWAYS

Near Term:

•Transparency

•Insurer Delivery

Long Term:

•Transparency

•Insurer Delivery

•Smart Devices